The end of the year is always a busy time for restaurant owners. Ensuring all your tax and sales data is in order can be a daunting task. In this guide, we’ll discuss reports that are available to help you to close out your accounting year.

1) Un-archiving

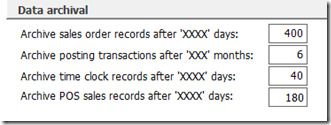

Before we start pulling reports, you will want to make sure the system is using all the data for the entire year. BPA is designed to archive sales information after a certain period; this allows the software to run smoothly. Occasionally, if these settings are changed, they will cause inaccurate reports for the entire year. To verify your archive settings go to Restaurant System>Manager Functions>Misc. Definitions. Select the Business System option on the left. In the right, you will see several headings; scan down until you see Data archival.

Here you will see a section with your data archive settings. Depending on which reports you need to access will determine which archive settings you may need to change. The business system reports and monthly and yearly sales reports are controlled by the top option – Archive Sales Order Records After ‘XXXX’ days. Most of the restaurant reports will be controlled by the Archive POS Sales Records After ‘XXXX’ days option.

As you can see from the example above, we will be able to pull any business system report going back 400 days. However, if we wanted to pull a restaurant report for the entire year, we would only be able to access the information 180 days back. If you need to access this information, simply change the number of days to reflect the entire time period required and hit Enter. The system will prompt you for your password and then warn you that everyone will need to exit out of the BPA software before making the change. The system may be unresponsive for a period of time while these changes take effect.

2) Sales and Tax Reports

Business Plus Accounting includes many reports to assist you with end of the year sales data. Some of the more useful are:

A) Yearly Sales Report

This report is located under Restaurant System>Manager Functions>Restaurant Reports. It gives a total of taxable sales, non taxable sales and the taxes calculated for each month as well as a yearly total. This particular report is controlled by the “Archive sales order records after 'XXXX' days” setting. If you see monthly sales missing from the report, try adjusting your archive settings and then running the report again.

B) Sales By Product Type and Hour

Many of our customers require information for the total number of food and alcohol sales that have taken place during the year. The Sales By Product Type and Hour report is designed to provide this information. It is located under Restaurant System>Manager Functions>Restaurant Reports and can be run for the entire year. This report is controlled by the “Archive POS sales records after 'XXXX' days” setting. By default, this is set to 180 days, so if you need to run this report for the entire year, you will need to change this setting.

C) Product Sales Tax Report

This report is located under Business System>Reports>Sales Reports. It lists all of your products which were sold as well as showing the sales tax percentage used for each. This also gives a sales tax total.

3) Payroll Reports and Forms

By using the payroll module in the BPA software, you have access to reports that will help you monitor the employee payroll. There are forms which can and can’t be printed. All of the following reports are located under Business System>Payroll.

A) Payroll History Report

Before closing out your payroll for the year, it is always good to double check your work. By printing the year’s total payroll history, you can verify that no payrolls were missed or duplicated. It will also allow you to verify that all of your year end totals are correct.

B) Payroll Tax Report

This report will give you the necessary information to fill in your 940, 941, and W-3 forms. However, the software does not print these forms for you. When you run the report it will ask you which quarter you would like. Enter “5” to run the report for the entire year.

C) W-2s

Once you have verified that everything in the payroll system is correct, you can print your W-2s. It is important to note that while the system will print all the information for you, it does not print the form itself. The form that BPA uses is the standard 2 UP form that can be purchased from Office Max and other office supply stores. If the forms you have purchased are the standard four copy W-2, you will need to print W-2s four times.