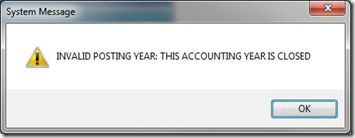

This time of the year our tech support gets a large amount of calls relating to not being able to post Payroll or Accounts Payable. The BPA software allows you to post information up to 1 year ahead of the current accounting year the software is set to. If you have not been using the general ledger in the BPA software many times this accounting period will remain unchanged. When you try to post you will see the following message.

This error is easily corrected by following these simple steps.

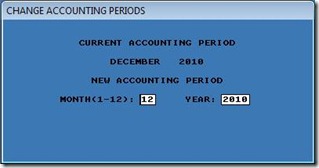

1) Go to Business System>General Ledger.

2) Select Change G/L Accounting Period.

3) Move the accounting period forward one month at a time until you get to the current year. In other words if it is set to 12/2010 you need to put in 1/2011 and hit enter. Enter “Y” to continue and hit enter again. Repeat these steps until you get to 1/2012.

It is important to remember that once you move your accounting period forward to the current year that you can no longer post to past years. If you are using Accounts Payable and still have payments that need to be posted to last year be sure to do so before you move all the way into 2012.

Moving the accounting period forward also affects one report that many of our customers use – the Product Activity Report. This report shows product quantities sold for each month throughout the year. When the accounting period is moved forward it updates this report to show quantities for the current year.